Orlando MSA Residential Real Estate Market Update - July 2016

What's up in the Orlando MSA Residential Real Estate Market?

The Orlando Regional Realtor's Association has released the most recent month's numbers for July, 2016. Read below to find out:

- How quick homes are selling.

- How close homes are selling to their asking prices.

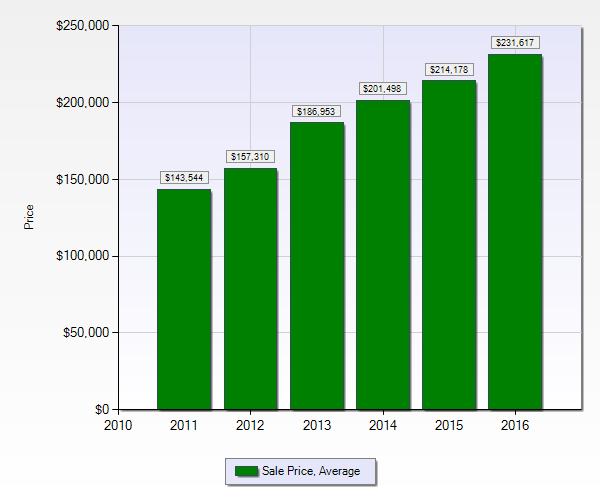

- How the average sales price has changed over the last 5 years.

- How many homes are on the market.

- Inside look into the next 12 months and an opportunity to track your property value.

A continued decline in available inventory has sent Orlando MSA median home prices rising 12.04% in July of 2016 compared to July of 2015 - the result, in part, to yet another almost double digit decline in inventory. Here is a look at the average sales prices over the last 5 years.

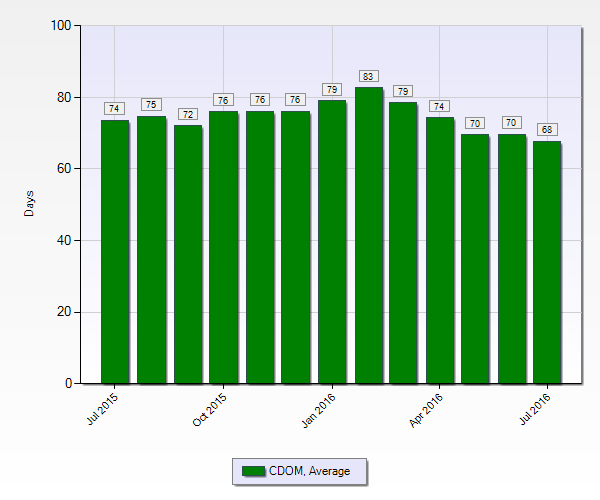

The number of days homes are on the market remains low. The current average time on market before coming under contract in July was 60 days. Our team's current average for 2016 is 22.5 days!

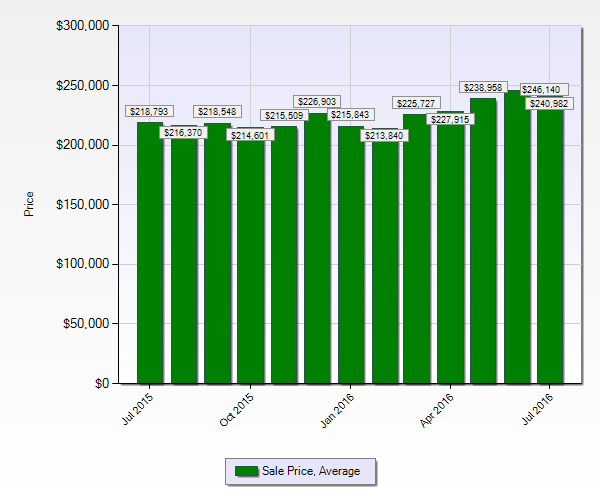

The original asking price compared to sales price ratio for July 2016 was 97.28%. That number was 96.9% for July of 2015. We are seeing buyers compete with multiple offers to get most homes under $350,000.

The average sales price increased from $218,793 in July of 2015 to $240,982 in July of 2016 for an increase of 10.14%.

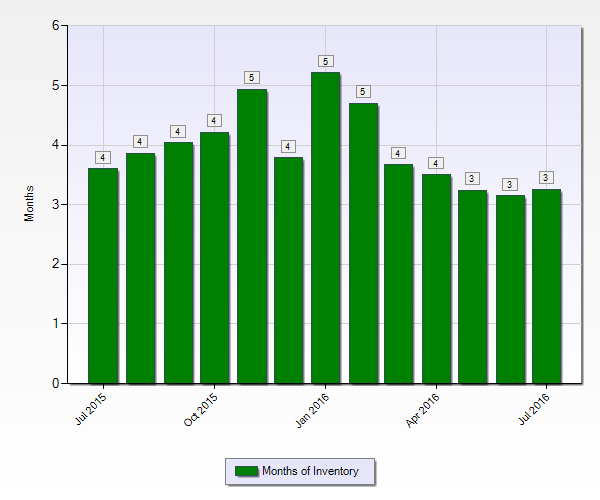

In July, we had 10,648 homes available for sale in the Orlando MSA. That number seems to be decreasing even as we roll into the summer months as lending rates are still low and new construction is not keeping pace. Keep an eye out for our August report to see where it trends. Current inventory combined with the current pace of sales created a 3.19 month supply of homes in Orlando for July so we are still leaning towards a seller's market.

AFFORDABILITY & MORTGAGE RATES

According to ORRA, the July affordability index is at 162.77% which means that Buyers who earn the reported median income of $57,266 can qualify to purchase one of 4,657 homes in Orange and Seminole counties currently listed in the local multiple listing service for $334,304 or less.

First-time homebuyer affordability in July increased a percentage point to 115.75% from last month’s 114.7%. First-time buyers who earn the reported median income of $38,941 can qualify to purchase one of the 2,198 homes in Orange and Seminole counties currently listed in the local multiple listing service for $202,068 or less.

For a hassle free way to stay up to date on what is selling in your neighborhood then feel free to call Christina at 407-340-1308 with the address of your home.

If you are currently renting, schedule a time to meet with us. We offer free consultation that will help you determine if buying or renting is right for you. There are rent to own options available as well.