Orlando MSA Residential Real Estate - October Market Update

What's up in the Orlando MSA Residential Real Estate Market?

The Orlando Regional Realtor's Association has released the most recent month's numbers for October, 2016. Read below to find out:

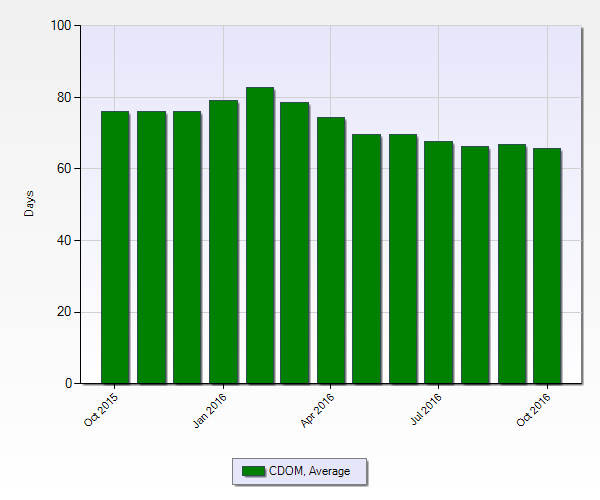

- How quick homes are selling.

- How close homes are selling to their asking prices.

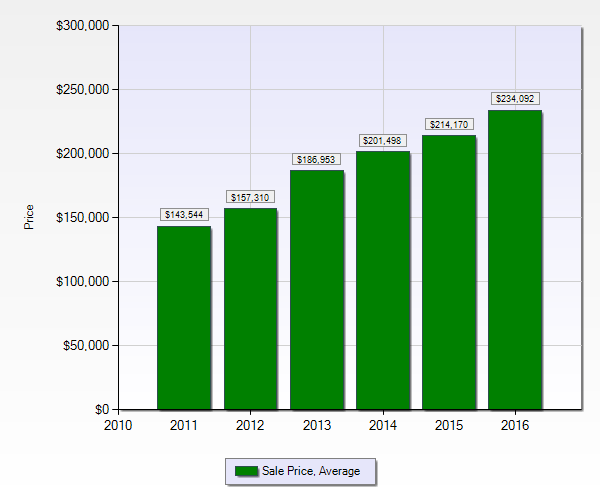

- How the average sales price has changed over the last 5 years.

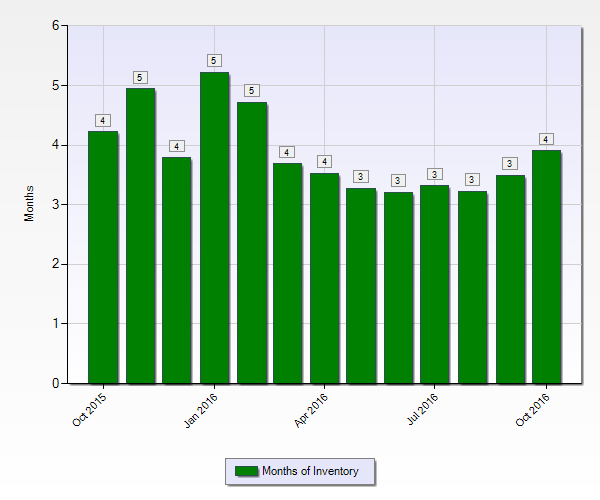

- How many homes are on the market.

- Inside look into the next 12 months and an opportunity to track your property value.

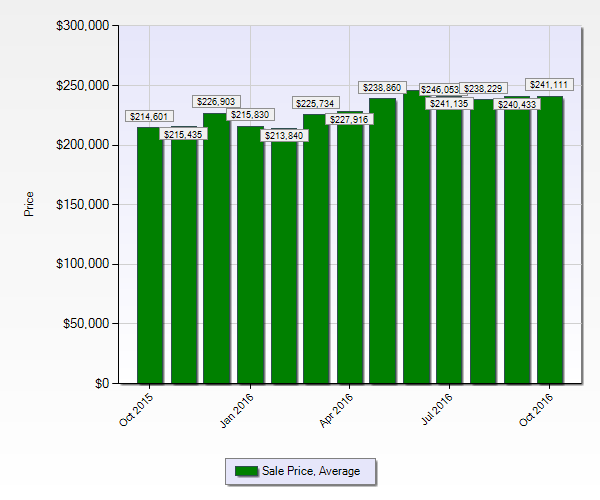

Orlando median home prices rose 14% in October of 2016 compared to October of 2015 - the result, in part, to declining inventory (12% Y.O.Y.) and a resulting decrease in sales. Housing inventory in Orlando has declined year over year for 16 straight months now, which is driving values upward and causing prospective buyers to either waver at the steeper home prices or become disheartened by the competition for the low number of available affordable listings.

Here is a look at the average sales prices over the last 5 years.

Homes of all types spent an average of 61 days on the market before coming under contract in October 2016. That number was 71 days in October of 2015. Our team's current average for 2016 is 19.8 days!

The original asking price compared to sales price ratio for October 2016 was 96.88%. That number was 96.76% for October of 2015. Our team's current average is 98%!

The average sales price increased from $214,601 in October of 2015 to $241,111 in October of 2016 for an increase of 12.35%!

In October, we had 10,025 homes available for sale of all types in the Orlando MSA which is 12.15% lower than last October. That number is still decreasing even as we roll into the Winter months as lending rates remain historically low. Keep an eye out for our November report to see where it trends. Current inventory combined with the current pace of sales created a 3.78 month supply of homes in Orlando for October so we are still slightly in favor of a seller's market.

AFFORDABILITY & MORTGAGE RATES

According to ORRA, the October affordability index is at 161.08% which means that Buyers who earn the reported median income of $57,437 can qualify to purchase one of 4,214 homes in Orange and Seminole counties currently listed in the local multiple listing service for $330,217 or less.

First-time homebuyer affordability in October decreased to 114.55% from last month’s 115.02%. First-time buyers who earn the reported median income of $39,057 can qualify to purchase one of the 1,953 homes in Orange and Seminole counties currently listed in the local multiple listing service for $199,598 or less.

For a hassle free way to find out what is selling in your neighborhood as soon as the sale closes then feel free to call Christina at 407-340-1308 or Tonio at 407-497-5705.

If you are currently renting, schedule a time to meet with us. We offer a free consultation that will help you determine if buying or renting is right for you!