Rising Interest Rates Explained in 36 Words

The Housing Market feels that President-Elect Donald Trump is a positive for the economy. The better the economy is the higher the mortgage rates are. The worse the economy is the lower the rates are. (That was just the 36 words...)

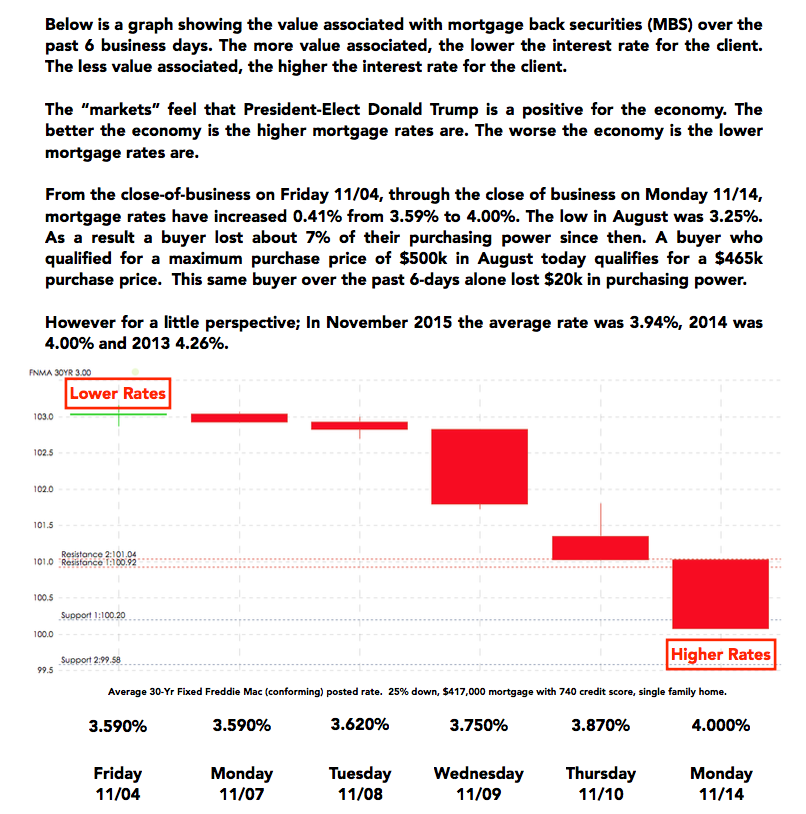

The 30-yr fixed rate has increased on average from 3.59% to 4% over the past 8 business days. As a result, a buyer who qualified for a $500,000 home in August lost about $35k in their purchasing power (the same person lost $20k in purchasing power over the past 6 days alone)! A $465,000 purchase price is roughly what they would qualify for now and don't forget this affects homeowners that are looking to sell their property too!

Translation

If you're sitting on the fence about buying a home right now then you're quickly losing purchasing power and losing out on taking advantage of historically low interest rates, especially with rates expected to keep rising in 2017.

The graph below depicts a breakdown of the interest rates over the past 6 business days. As we mentioned above, if you are thinking of selling, this also affects how much you can sell your home for.

With the market rapidly changing now and in the near future, who do you know that could use our help to navigate the purchase or sale of a home?